Boulder Burgundy Festival is now a non-profit.

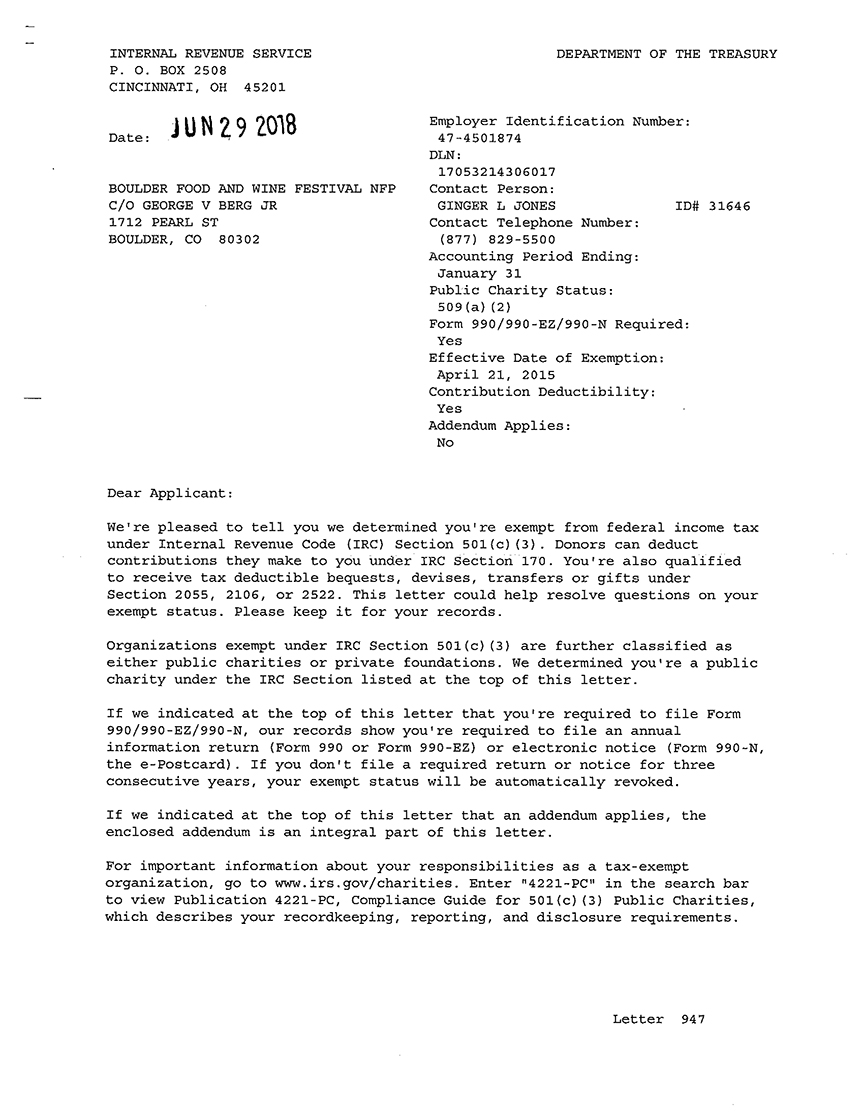

Earlier this month, we received a letter from the IRS:

“We’re pleased to tell you,” it read, “we determined you’re exempt from federal income tax under Internal Revenue Code (IRC) Section 501(c)(3). Donors can deduct contributions they make to you under IRC section 170. You’re also qualified to receive tax deductible bequests, devises, transfers or gifts under Section 2055, 2106, or 2522.”

The Boulder Burgundy Festival is now officially a non-profit. Not only are we now tax-exempt, but your support of the festival is also now valid as a charitable tax deduction.

Now in its eight year, the gathering has always been focused on raising awareness of and money for local charities. Over the years, we’ve raised tens of thousands of dollars for our partners.

We couldn’t be more thrilled to have finally achieved our 501(c)(3).

Please click here to read about this year’s causes.

And thank you for your continued support. We look forward to seeing you at this year’s festival.

Trackbacks/Pingbacks

[…] attend, the Boulder Burgundy Festival highlights and sponsors charities every year. For 2018, the not-for-profit festival will host the Somm Foundation, Chefs Cycle – No Kid Hungry, and There With […]